Nano-filtration membranes

Ionic holds the exclusive worldwide licence to commercialise the key intellectual property (owned by Monash) that underpins our graphene membrane products.

Ionic aims to generate initial revenue from graphene membrane products in 2017.

Technology

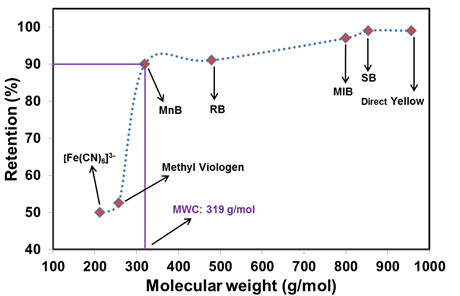

Graphene membranes can be tailored for the efficient and effective removal of a wide range of contaminants and materials from water or other liquids.

These qualities mean that our graphene nano-filtration membranes have broad potential in water treatment and mining applications.

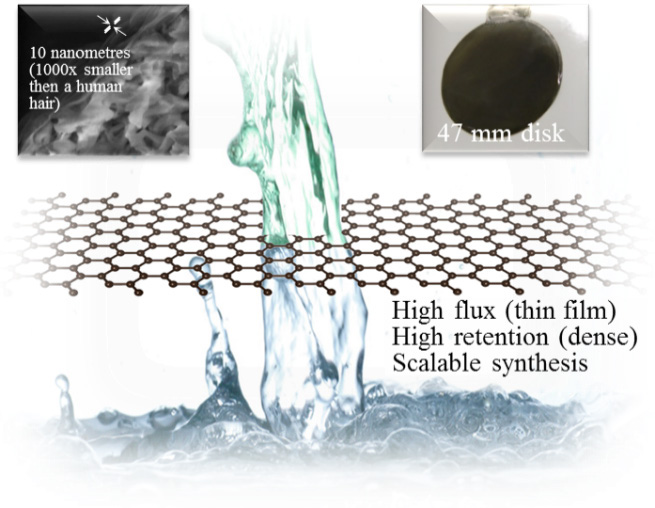

Graphene membranes have a range of extraordinary properties that are likely to generate superior performance to current polymer-based technologies:

- High chemical resistance making them safer and lower maintenance

- 10 x higher flux than polymer membranes resulting in much greater efficiency

- High mechanical strength for reduced maintenance and lifetime cost

- Tuneable selectivity during manufacture for precise customisation

Industrial scale membrane processes would require over hundreds of square meters of membrane area. To achieve this in an efficient manner (from the standpoints of cost and containment volume), membranes are packed into a housing known as a “module”, which can be retrofitted to existing membrane processes for trialling and evaluation with potential end-users. As a value-added product the membrane modules have higher business end-value than the membranes themselves, and we see this as key to exploiting the full value of our graphene membrane technology. Ionic is proposing to engage a global leader in membrane manufacturing for upscaling graphene membrane fabrication and development of membrane modules.

Achievements / publications

Our graphene membranes program is well advanced as the milestones below highlight:

- Research has been under way for 3 years.

- Research has been supported by an Australian Research Council industry linkage grant.

- Monash has filed a provisional patent application in Australia and has granted Ionic a Licence to the intellectual property the programme has generated.

- Ionic and Monash have the current capability to create 120 x 130 mm membranes.

- The production of membranes is a scalable process and Ionic is confident that the technology to create large graphene membranes is within reach.

The Monash research team has also hit a further series of milestones in the development of graphene membranes and the technology is now assessed at Technology Readiness Level 4.

The research team has received international acclaim for its work on graphene membranes. In April 2015, Associate Professor Majumder presented his work on ‘Graphene-based fluidic systems: From compact micro/nano-fluidic devices to large area filtration membranes’ to the Royal Society London. The event, titled ‘Nanostructured carbon membranes for breakthrough filtration applications: advancing the science, engineering and design’, featured talks by the leading researchers on filtration from the UK, France, USA, Switzerland, Germany, South Korea and Australia.

The world’s oldest and most prestigious scientific society, presided over by the likes of Sir Isaac Newton and Sir Joseph Banks, The Royal Society is a world attention-calling platform for the important topics of the age. In this case, the concern was water purity and the way that carbon-based membranes can efficiently desalinate seawater and treat wastewater.

Markets

Ionic Industries’ graphene membranes will target the global market for filtration membranes. Polymer-based technologies currently dominate the market, however graphene membranes represent the next wave of evolution in this market and have disruptive potential. We expect our technology to acquire market share as a substitute for those applications that are currently served by polymer-based technologies.

Global demand for membranes is currently projected to increase a healthy 9.2 percent annually to constitute a global market-size by sales of $25.7 billion in 2017. The drivers of demand for membranes will be increased investment in water and wastewater treatment systems required as a result of rising environmental standards and regulations in many parts of the world and high population growth, particularly in water-stressed areas. Increased attention paid to food and beverage safety regulations and rising interest in water reuse and material reclamation is also likely to propel membrane sales.

The countries expected to see the fastest growth include the BRIC (Brazil, Russia, India, and China) countries and other countries with large, developing industrial bases and stressed local water resources. Combined, the US and China, the two largest national markets for membranes in 2012, are expected to account for 43 percent of the market gains between 2012 and 2017.

By 2012, the Asia/Pacific region had surpassed North America to become the largest regional market, with 36 percent of global membrane sales. This region is led by the rapidly developing Chinese market, which represented 15 percent of global demand in 2012 and is projected to post the fastest growth rate through the forecast period. North America accounted for 27 percent of global membrane sales in 2012. Demand growth in North America is expected to accelerate through 2017 from the more modest gains of the 2007-2012 period. Advances will be aided by the ongoing development of improved membranes to accommodate newer water quality regulations, the use of low-quality water in water-stressed regions, and rising interest in the more efficient use of water. Western Europe and Japan are similar to the US in the maturity of local water infrastructures, the type of regulatory environment, and the level of technological sophistication in manufacturing. Despite this relative maturity, the rising emphasis on water recycling will boost sales. The comparative affluence of these countries allows for the use of advanced technologies despite their high upfront costs.

In developing countries, the opportunities are likely to be based on the continued growth of water-intensive industries and rising investment in water and waste infrastructure, particularly in areas that need to tap brackish or otherwise poor quality water resources. However, in many of the least-developed countries — especially in Africa and parts of South Asia — growth is expected to be more limited due to a lack of adequate funding and the availability of lower-cost options such as conventional filters. Treatment of seawater and brackish water sources is a key use for membranes in certain regions. For instance, much of the Middle East, North Africa, and the Caribbean have invested in membrane-based systems to ensure a sufficient supply of water for drinking, agriculture, and industry use. Historically, thermal distillation plants were more common, but even oil-rich nations are switching to more efficient reverse osmosis and other membrane-based desalination technologies. Other countries outside of these regions, including Australia, China, India, Japan, Singapore, Spain, and the US, have also added membrane-based desalination capacity in recent years.

Water treatment, the largest market for membranes, is also likely to benefit from expansions or upgrades of water treatment infrastructures and a projected rebound in manufacturing activity in key geographic markets. However, the fastest growth will emerge in the pharmaceutical and medical market, and other smaller markets such as chemical processing and environmental applications, as these industries continue to develop and create new uses for membranes.

Leading suppliers of membrane materials include EMD Millipore (Merck), Pall, Toray Industries, General Electric, Nitto Denko, Dow Chemical, and Asahi Kasei. Together, these seven firms accounted for 17 percent of global membrane sales in 2012. The industry is also supported by a wide variety of companies that design, build, and operate membrane-based systems.

Next steps

The objective of our phased developmental program is to see the technology at TRL 8 by 2017: Actual system completed and qualified through test and demonstration.